Risk Management

Importance and Mission

Ichitan Group Public Company Limited is committed to fostering the organization’s growth in alignment with its strategic objectives through effective risk management. This approach aims to mitigate business risks, minimize potential losses and identify business opportunities within key environmental risk factors that impact operations. The Company ensures compliance with relevant laws, regulations and international standards while actively opposing corruption, safeguarding stakeholder interests under good corporate governance principles and managing risks related to technology, innovation and emerging threats that could affect business operations. To achieve both short-term and long-term business and investment goals, the Board of Directors has continuously integrated risk management into the Company’s corporate culture.

Stakeholders Directly Impacted

Investors / Shareholders

Consumers

Employees

Business Partners / Creditors

Competitors

Goal and Performance Highlights

Goals

Management Approach

- Established a corporate risk management policy and framework.

- A Risk Management Committee is appointed to define policies, oversee risk management frameworks and monitor the assessment of risks and opportunities. The committee is also responsible for reporting on the implementation of risk management plans to the Board of Directors on a quarterly basis.

- Cultivates awareness among directors, executives and employees at all levels regarding business risk management, embedding it as part of the corporate culture.

Implementation and Performance

The Board of Directors, executives and employees at all levels of Ichitan Group Public Company Limited recognize the significance and benefits of applying risk management standards in business operations. The Company has integrated risk management into its strategies and across all processes in the supply chain, addressing potential impacts from both internal and external environmental changes. The organization also adapts to global crises characterized by volatility, uncertainty, complexity and ambiguity, which evolve rapidly, making outcomes unpredictable and decision-making more challenging.

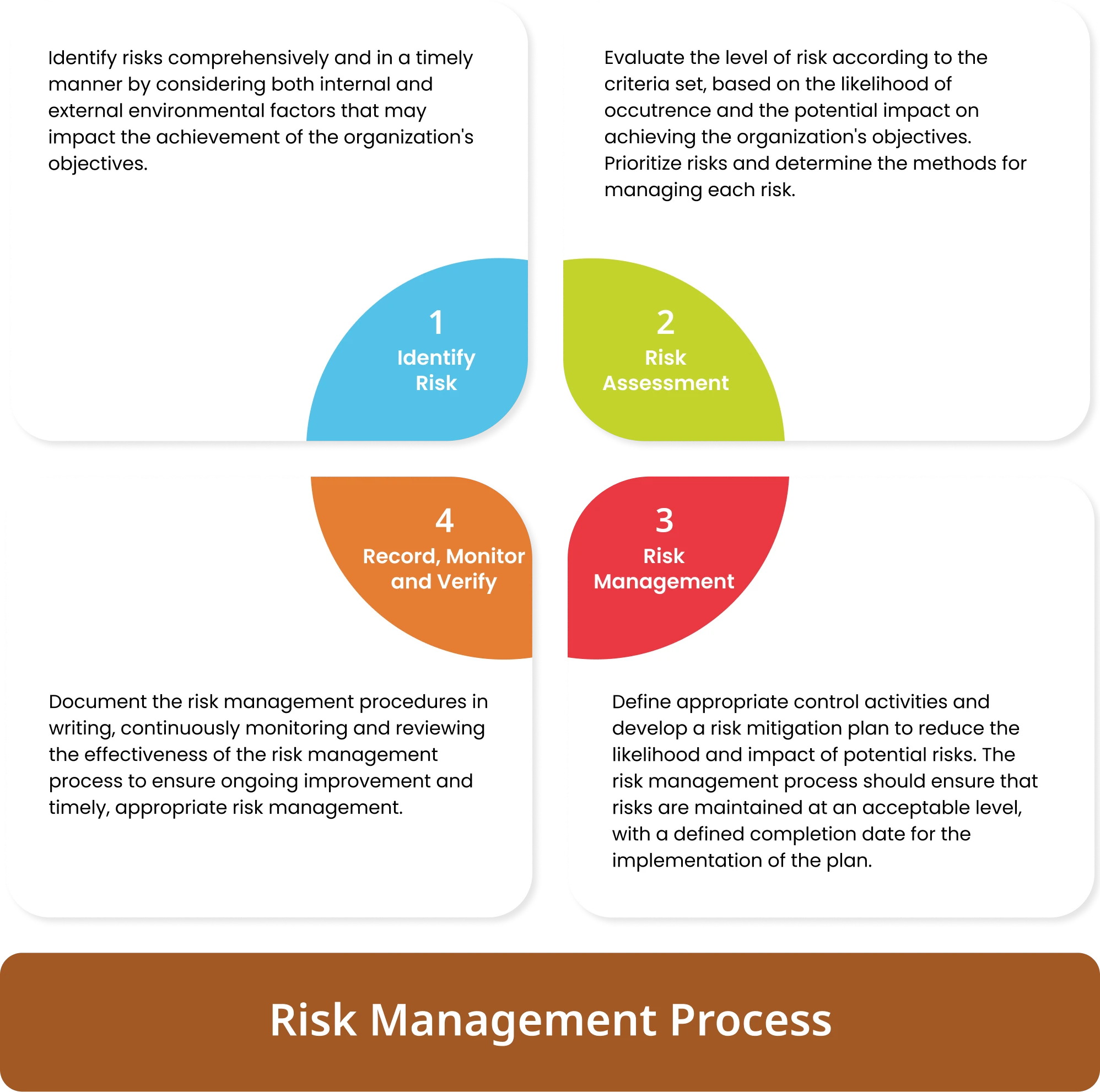

The Company has formulated a risk management policy and established a comprehensive risk management framework. This framework encompasses risk identification, likelihood and impact assessments and the development of preventive measures and risk management plans covering all types of risks. These measures align with the organization’s risk appetite framework and corporate governance code. Additionally, the Company has adopted the Enterprise Risk Management (Integrating with Strategy and Performance), integrating 5 components and 20 principles of enterprise risk management with strategy and performance. A risk management task force has been assigned to monitor the implementation of risk management plans in collaboration with the risk management and internal audit departments. This ensures effective operations under good corporate governance practices, in alignment with the Company’s strategic direction and objectives. The task force regularly reports risk management outcomes to the Risk Management Committee and presents findings to the Board of Directors on a quarterly basis.

Furthermore, the Company promotes a risk-aware culture among directors, executives and employees at all levels, ensuring that risk management principles and business opportunities are actively applied. The Company emphasizes the role of senior and mid-level executives in exemplifying and implementing risk management practices while fostering knowledge transfer to operational levels in a sustainable and tangible manner

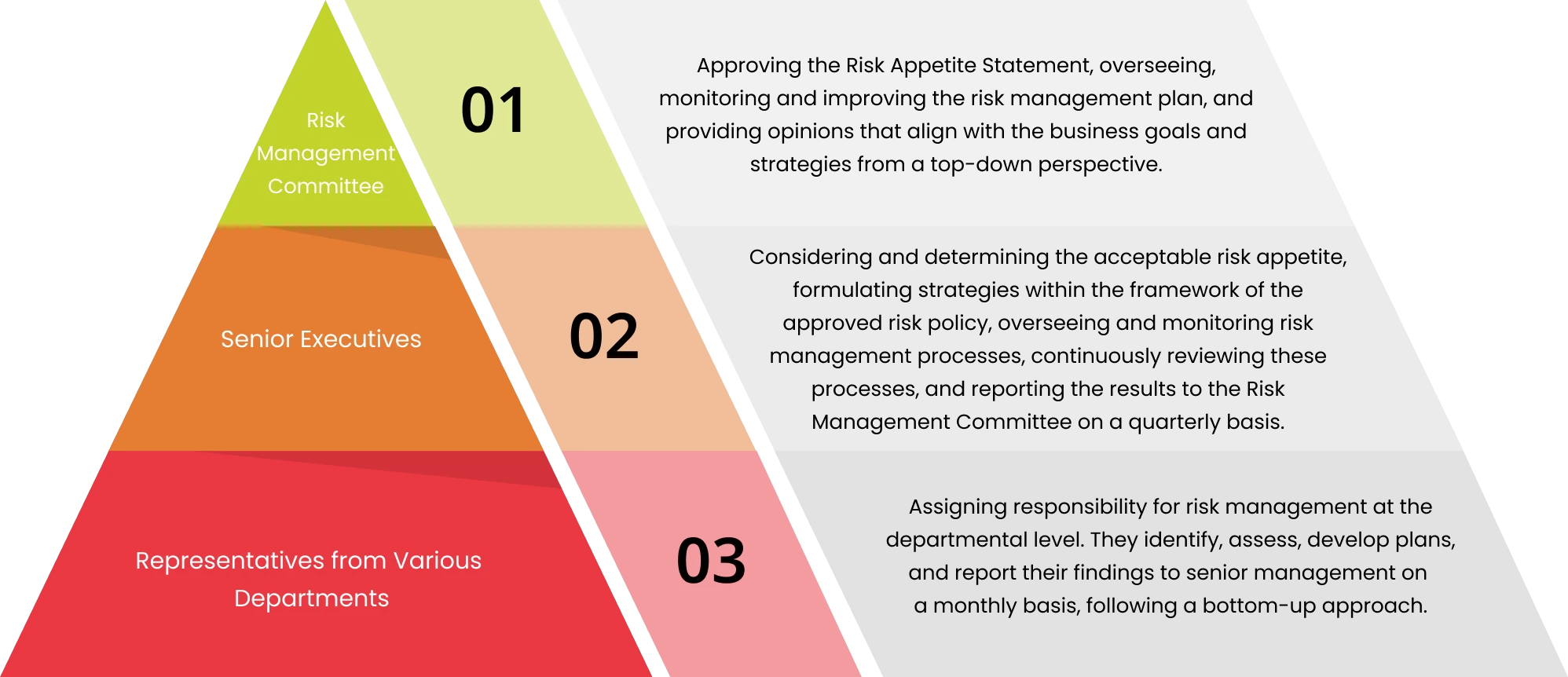

The Company has established a 3-tier risk management structure. The Board of Directors has appointed the Risk Management Committee to oversee, monitor and review enterprise risk management while ensuring that risk management guidelines align with corporate objectives and current circumstances. The Risk Management Working Committee is responsible for driving the risk management process and continuously monitoring the progress of implementation plans.

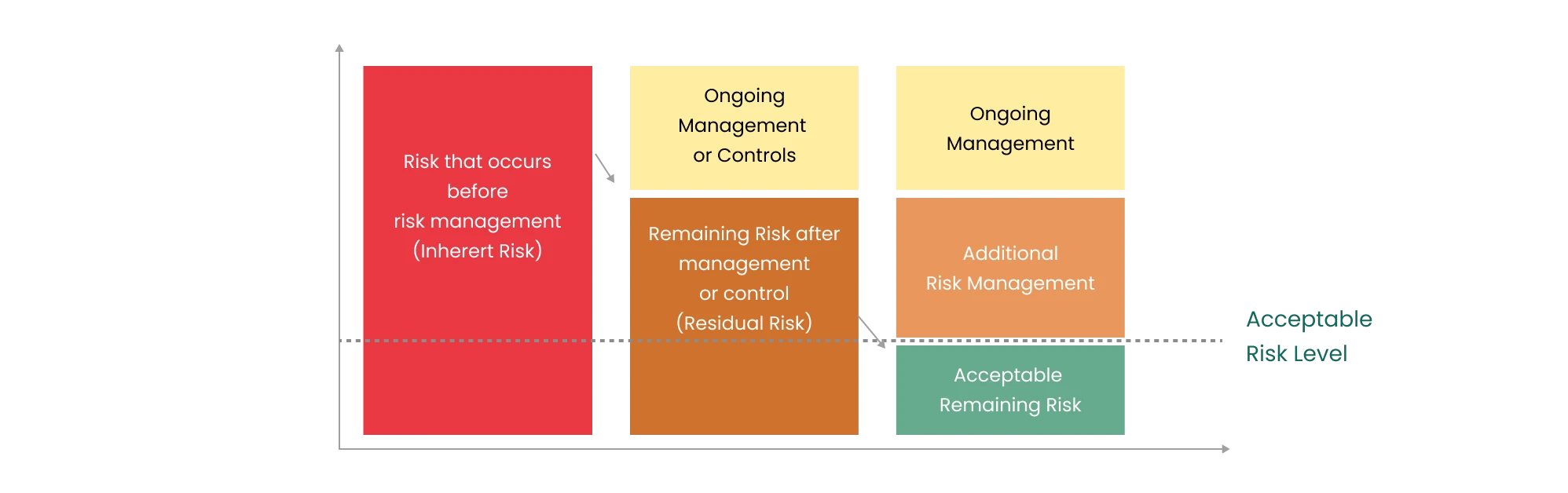

The Company prioritizes risks by assigning a risk owner responsible for analyzing risk issues. Risk analysis involves assessing risk factors that impact business operations and identifying the root causes of risks. Risk evaluation determines the severity of risks in relation to each risk factor and establishes criteria for assessing the likelihood of risks occurring and their potential impact. Additionally, the Company defines an acceptable risk level for each root cause, considering both the current and desired levels in terms of probability and severity if the risk materializes. Risks are then ranked by priority to focus on the most significant risks using a risk matrix, with evaluation criteria for likelihood and impact classified into 4 levels as follows:

| Level | Description | Color | Meaning |

|---|---|---|---|

| 4 | Very High | Red | The level of risk that is unacceptable requires immediate risk management to bring it to an acceptable level. |

| 3 | High | Orange | The level of risk that is unacceptable requires ongoing risk management to maintain it at an acceptable level. |

| 2 | Medium | Yellow | The level of risk that is acceptable requires control measures to prevent the risk from moving to an unacceptable level. |

| 1 | Low | Green | The level of risk that is acceptable does not require risk control or further management. |

Risk assessment was conducted based on impact and likelihood as follows:

| Risk Assessment Criteria; Severity and Opportunity | |||||||

|---|---|---|---|---|---|---|---|

| Severity | |||||||

| Reputation | Strategy/Goals | Operations | Financial | Legal | Management/Control | Rating | |

| Revenue Loss | Expense Loss | ||||||

| Very High Severe damage to the organization's reputation or image | Very High Impact on strategic goals, important KPIs at an unacceptable level (>10%) | Very High Failure of governance/operations halted for > 1 day (or according to the target of each department that is unacceptable, leading to failure) | Very High Impact on revenue > 10% of the target. | Very High Expense loss exceeds budget by >10% or additional expense loss > 10 million Baht. | Have From regulatory agencies, legal requirements, SET regulations or new laws related to business. | Very High Identified significant management/control weaknesses/loopholes, unacceptable, resulting in management failure | 4 |

| High Severe damage to the organization's reputation or image | High Impact on strategic goals/KPIs at an unacceptable level (6-10%) | High Failure of governance/operations halted for 7-24 hours (or according to the target of each department that is unacceptable) | High Impact on revenue 6-10% of the target | High Expense loss exceeds budget by 6-10% or additional expense loss between 3.5-10 million Baht. | - | High Identified significant management/control weaknesses/loopholes, with unacceptable impact | 3 |

| Medium Slight damage to the organization's reputation or image | Medium Impact on strategic goals/KPIs at a slight, acceptable level (1-5%) | Medium Failure of governance/operations halted for 1-6 hours (or according to the target of each department that is acceptable) | Medium Impact on revenue 1-5% of the target | Medium Expense loss exceeds budget by 1-5% or additional expense loss between 1-3.5 million Baht | - | Medium Identified management/control weaknesses/loopholes with acceptable impact | 2 |

| Low No impact on the organization's reputation or image | Low No impact on strategic goals/KPIs (0%) | Low Failure of governance/operations halted for <1 hour (or according to the target of each department) | Low Impact on revenue < 1% | Low Expense loss exceeds budget <1% or additional expense loss <1 million Baht | None No complaints from regulatory agencies regarding legal requirements, SET regulations or new laws related to business. | Low No identified weaknesses/loopholes in management/control | 1 |

| Risk Assessment Criteria; Severity and Opportunity | ||

|---|---|---|

| Opportunity | ||

| Control | Opportunity for happening | Rating |

|

Very High Lack of control management to the extent that it is impossible to prevent the occurrence of incidents |

Very High The likelihood of occurrence is greater than 50% within 1 year |

4 |

|

High There are incomplete control management methods that cannot fully prevent the occurrence of incidents |

High The likelihood of occurrence is between 31-50% within 1 year |

3 |

|

Medium There are control management methods that have a good preventive effect on the occurrence of incidents, at an acceptable level |

Medium The likelihood of occurrence is between 11-30% within 1 year |

2 |

|

Low There are control management methods that can be confidently relied upon to fully prevent the occurrence of incidents |

Low The likelihood of occurrence is less than or equal to < 10% within 1 year |

1 |

More over, the Company has a structured risk management process to analyze and assess key risks that affect its operations, including strategic risk, operational risk, financial risk, compliance risk and emerging risks. The following outlines significant risk factors and newly implemented risk management measures:

Geopolitical Conflict Risk

Potential Impacts

- Disruptions in the supply chain leading to reduced product availability, increased production costs, and higher operational expenses.

- The company must enhance adaptability and adjust its product portfolio strategies.

- Declining consumer demand.

Risk Management Measures / Mitigation Strategies

- Closely monitor geopolitical and economic developments.

- Implement scenario planning and develop business continuity management (BCM) plans to address potential disruptions.

- Foster cross-departmental collaboration within the organization to expand supplier networks, diversify market opportunities, and enhance supply chain flexibility to mitigate the risk of disruptions. Additionally, explore cost-reduction opportunities by identifying alternative raw material sources, optimizing logistics, modifying production formulas, and maintaining inventory reserves to prevent raw material shortages.

Climate Change or Natural Disasters Risk

Potential Impacts

- May result in increased costs due to the scarcity of raw materials.

- Sudden environmental disasters could impact the Company’s business continuity through damage to assets and essential natural resources.

- Natural disasters may also cause harm to assets, injuries and loss of life among employees.

- Extreme heat could lead to severe health issues for workers, such as exhaustion and other heat-related illnesses.

- Rising temperatures may increase air pollution levels and the presence of harmful toxins affecting workers, including fine particulate pollution (PM) and air pollution accumulation due to stagnant weather conditions.

- Furthermore, increased temperature and humidity may deteriorate product quality by altering nutritional composition, color and texture during production, storage and transportation.

Risk Management Measures / Mitigation Strategies

- To manage these risks, the Company assesses and evaluates the locations of its facilities to develop structural improvements, upgrade infrastructure, and enhance existing assets as necessary.

- A climate management plan and strategy are established, focusing on improving energy efficiency and investing in energy-saving technologies such as alternative and renewable energy projects while tracking progress toward reducing greenhouse gas emissions in line with set targets.

- Safety policies and heat management guidelines are implemented, including adequate water supply, rest periods and well-ventilated workspaces.

- Additionally, employee training programs are conducted to raise awareness about climate change and best practices for mitigation.

Raw Material Shortages or Key Production Factors Risk

Potential Impacts

- The scarcity of essential materials leads to production disruptions, affecting sales and revenue.

- This could result in increased costs, impacting profit margins.

- If products are unavailable in the market, customers may turn to competitors.

- Supply shortages may destabilize the entire supply chain, leading to uncertainty in production processes.

Risk Management Measures / Mitigation Strategies

- The Company optimizes inventory management by maintaining reserves of critical raw materials to meet future demand.

- Strong relationships are established with multiple suppliers to ensure alternative sourcing options in case of shortages.

- Contingency plans are developed, including regular risk assessments, to prepare for potential disruptions in the supply of raw materials.

- Communication with supply chain stakeholders ensures all parties are informed and can collaborate on solutions.

- New production technologies and innovations to minimize raw material usage and enhance efficiency.

The Company recognizes that all employees and departments play a crucial role in managing risks within acceptable levels. Cultivating a risk management culture is fundamental to the success of the Company’s risk management efforts. Therefore, the importance of risk management is communicated throughout the organization via various channels, such as annual corporate risk management seminars, the publication of corporate risk management handbooks, knowledge sharing and activities related to risk management for directors, executives and employees at all levels. These initiatives aim to foster discussions and exchanges of perspectives on various risk-related topics, including integrated crisis risk and opportunity management under ESG principles for sustainable growth for Ichitan in alignment with the GRC (Governance, Risk and Compliance) framework for the Board of Directors. Climate change and its potential impact on business operations are also key discussion topics for employees at all levels.

100%

of the company’s directors, executives and employees at all levels have received risk management training.

100%

all organizational units have implemented risk management measures and guidelines.

Our Activities

Ichitan Group Public Company Limited has continuously carried out sustainability initiatives, focusing on environmentally and socially responsible production.